Enhance the Effectiveness of Carbon Credit Exchanges

The Paris accord on climate change sets an ambitious goal of limiting the rise of global temperatures to 1.5 degrees Celsius, which will require a drastic reduction in carbon emissions. While individual companies and other entities can meet most of this requirement through a shift to renewable energy sources, operating practices, and other methods, some will need to buy carbon credits from others. A robust, effective voluntary carbon market could make it easier for buyers to locate sellers and complete transactions.

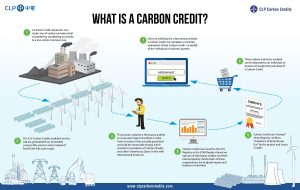

A carbon credit is a permit that represents one metric ton of CO2 or equivalent greenhouse gases reduced, avoided, or removed from the atmosphere. These permits can be sold to individuals and companies to compensate for their own emissions, such as those generated by industrial production or delivery vehicles. The price of a carbon credit exchange can vary greatly depending on the type and location of the project that produces it. For example, credits from community-based projects that generate co-benefits, like improved water quality or economic equality, may trade at a premium to those from industrialized projects.

Currently, there are several environmental commodity exchanges that list carbon offset credits for sale and work with registries to enable transactions. The Xpansiv CBL and ACX exchanges, for instance, offer products with different levels of transparency that are meant to appeal to buyers. However, the heterogeneity of the market and the number of factors influencing prices mean that they can be difficult for traders and other players to understand the true value of a credit.

How Blockchain Can Enhance the Effectiveness of Carbon Credit Exchanges

A carbon trading platform that uses blockchain can help solve these problems by consolidating trading activity around standardized contracts and making them available to a wide audience. By bringing together investors, brokers, and traders in a single platform, this kind of carbon trading can reduce the friction that has kept many potential participants away from the market, as well as helping to create an efficient marketplace for those already active in it.

Another way that blockchain can be used to enhance the effectiveness of a carbon credit exchange is by enabling its participants to create and share granular attributes about the credits they are selling or purchasing. These attributes can include the specific type of underlying project, the geographic location, and the vintage (or age) of the carbon project. This level of transparency can be a valuable tool for buyers and sellers alike, as it provides them with the information they need to understand the value and authenticity of a credit.

Standardized carbon products that are based on the core carbon principles and a consistent set of additional attributes would make it easier for traders to understand the true value of a credit. In addition, by using a standardized product, users would be able to compare the price of carbon credits from different projects and make the best decision for their specific needs. For these reasons, many experts believe that blockchain will be a significant contributor to the success of carbon credit exchanges.